One of the most common reasons to lose money in Forex trading is by not using a longer-term goal with the higher time frames, such as the weekly or the monthly. This writing will explain how we can utilize the weekly time frame for our own gain and outline the trading rules based on historical performances.

Time frame in CFD market

This indicates the unit in the chart that shows the timing in seconds, minutes, hours, days, months, and years. In a Japanese candlestick chart, the weekly chart can show the seven days of the week, and each candlestick means 5 minutes of time. The shorter it is, the more detailed the price movement it shows. The longer it is, the more it shows us the market trends at present.

Benefits of weekly time span

Forex timeframes are effective and powerful tools that make our business profitable as we can see the process of currency pairs and the trends with the graphical representation of this platform. The weekly time span is easier to evaluate, but it is also a good idea to use a shorter this chart so that we can get the report in a more concise way. Try not to deal with the CFD market with emotional stress. Trade based on what you see not on what you believe or feel.

Measuring the trend

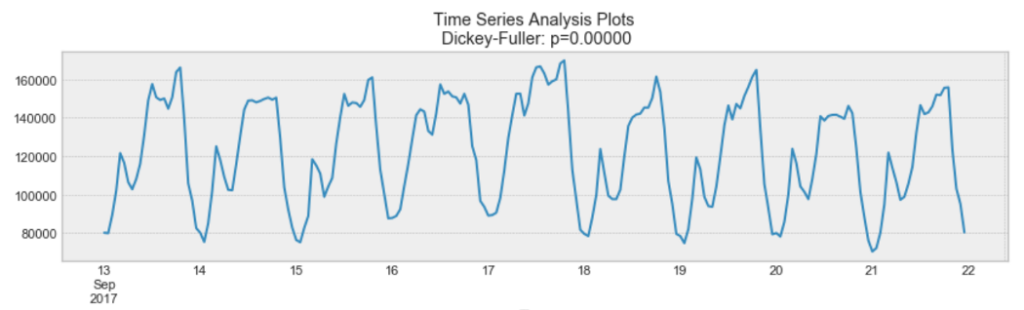

The weekly timeframe is considered best as it shows the historical data based on the month, and an investor can find out when the price was in a higher position and when it was in a lower position. To get the best result in a weekly chart, we can count back from 26 weeks to 13 weeks on a candlestick pattern and try to create the best trend indicator that will pull up our previous trading data.

After getting the data, we should try to answer a few questions, like if the price is lower now than it was previously at the same time, or if the price is higher now than it was previously at the same time? Weekly traders in the Mena zone should execute their trades on a reversal pattern of the resistance and support level without focusing on the long-term trend.

Using the timeframe in trading

Though the weekly timeframe gives us data clearly, this is not a smart way to follow only the weekly chart as there are so many other options that need to be focused on. According to experts, if a beginner uses just a single timeframe to conduct his trading business, then it will be regarded as a bad idea because it has some good sides and some bad sides, and without using so many time frames, we cannot come to a decision at last.

We should not use this shorter only because using the result of a shorter time based on 5 minutes candle, we cannot take the result of 50 weeks or one year using this chart. In fact, sometimes, few brokers set a time limit, which compels an investor to close his financial instrument soon without making a greater amount of profit by losing all the opportunity. Experts try to make a combination of the shorter and longer it to reach their goals as they know very well that getting biased in only one chart cannot give you any appropriate results that could be helpful in sharpening your strategies.

On the basis of minute observation, now we can say that to use the weekly timeframe properly, one must study its basic uses, and this process can be easier for a beginner if he takes practical lessons from a mentor. But one should never use one type of time span to execute his business. This is because without having a proper picture of the timeframe, it is not possible for anyone to understand the market condition.