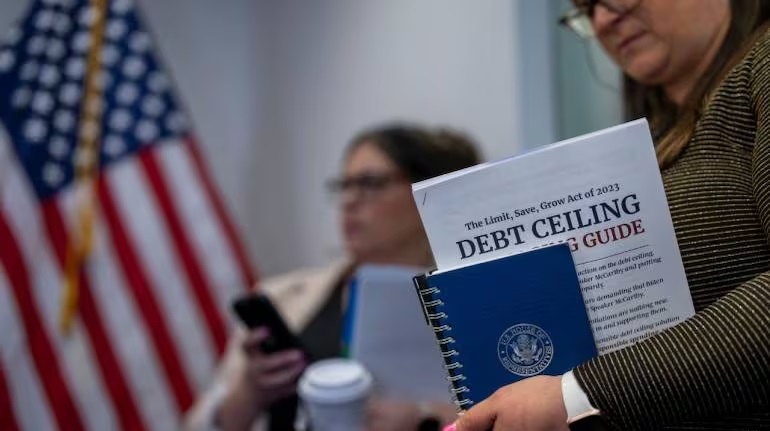

The U.S. debt ceiling, often making headlines and stirring political debates, is a critical component of the nation’s fiscal policy. It represents the legal limit on the amount of debt the U.S. government can accumulate to finance its operations and meet its obligations. In this article, Kavan Choksi will explore the intricacies of the U.S. debt ceiling, its history, impact, and the debates surrounding it.

What is the U.S. Debt Ceiling?

The U.S. debt ceiling, also known as the debt limit, is a statutory limit set by Congress on the total amount of debt that the federal government can issue. It includes both publicly held debt (debt held by investors and foreign governments) and intra-governmental debt (debt the government owes to itself, such as the Social Security Trust Fund). When the government reaches this limit, it cannot borrow more money to meet its financial obligations unless Congress raises or suspends the ceiling.

A Brief History

The concept of a debt ceiling dates back to the First World War when Congress first authorized a limit on federal debt. Over the years, the ceiling has been raised or suspended numerous times to accommodate the country’s growing financial needs. However, the debt ceiling has become a contentious issue in recent decades, often leading to political standoffs and last-minute negotiations.

Key Points to Understand

- Necessity of Borrowing: The U.S. government borrows money by issuing Treasury bonds and other securities to cover budget deficits caused by expenditures exceeding revenue.

- Raising the Ceiling: When the government approaches the debt ceiling, Congress must pass legislation to raise or suspend it, allowing the Treasury to continue borrowing to meet its obligations.

- Impact of Default: Failing to raise the debt ceiling could result in the U.S. defaulting on its obligations, which could have severe consequences, including a potential financial crisis and harm to the country’s creditworthiness.

Debates and Controversies

- Political Battleground: The debt ceiling has often become a political battleground, with both parties using it as leverage to advance their policy agendas. Debates over the ceiling have led to government shutdowns and financial market volatility.

- Economic Implications: Economists and financial experts warn that a default or even the prolonged uncertainty surrounding the debt ceiling can harm the economy, increase borrowing costs, and erode consumer and investor confidence.

- Long-Term Fiscal Challenges: Critics argue that relying on the debt ceiling as a tool for fiscal restraint is shortsighted. They contend that addressing long-term fiscal challenges, such as entitlement reform and tax policy, is more critical to fiscal responsibility.

The U.S. debt ceiling is a critical aspect of the nation’s fiscal policy, representing the legal limit on government borrowing. While it has been a source of political debates and controversies, understanding its necessity and potential consequences is crucial. Managing the debt ceiling responsibly is essential to ensuring the country’s financial stability, economic growth, and ability to meet its obligations. Ultimately, addressing the nation’s fiscal challenges in a comprehensive and bipartisan manner is key to mitigating the recurrent debates and uncertainties surrounding the U.S. debt ceiling.